Many investors explore commercial properties for sale to secure income and long term growth. These properties allow owners to earn from rent, attract steady tenants, and build equity over time. In many growing cities, commercial real estate supports retail, office, and mixed use needs. Buyers often review location, zoning, and pricing before making decisions. With proper planning, commercial investments can deliver reliable returns and future appreciation.

What Are Commercial Properties For Sale

People use the term commercial properties for sale when talking about buildings or spaces that are used for business. These places are not homes. They are shops, offices, warehouses, and small centers. People buy them to rent to businesses or to open their own stores.

How They Work

These places are called commercial investment properties for sale when someone buys them to make money. They earn money from rent paid by business tenants. The rent can help pay for the loan and repairs. It can also give steady income.

Who Buys Them

Many buyers include business owners, families, and small groups. They look at size, price, and location. Also, they look at how many people visit the area and how easy it is to park. Better access can mean more value later.

Where They Can Be Found

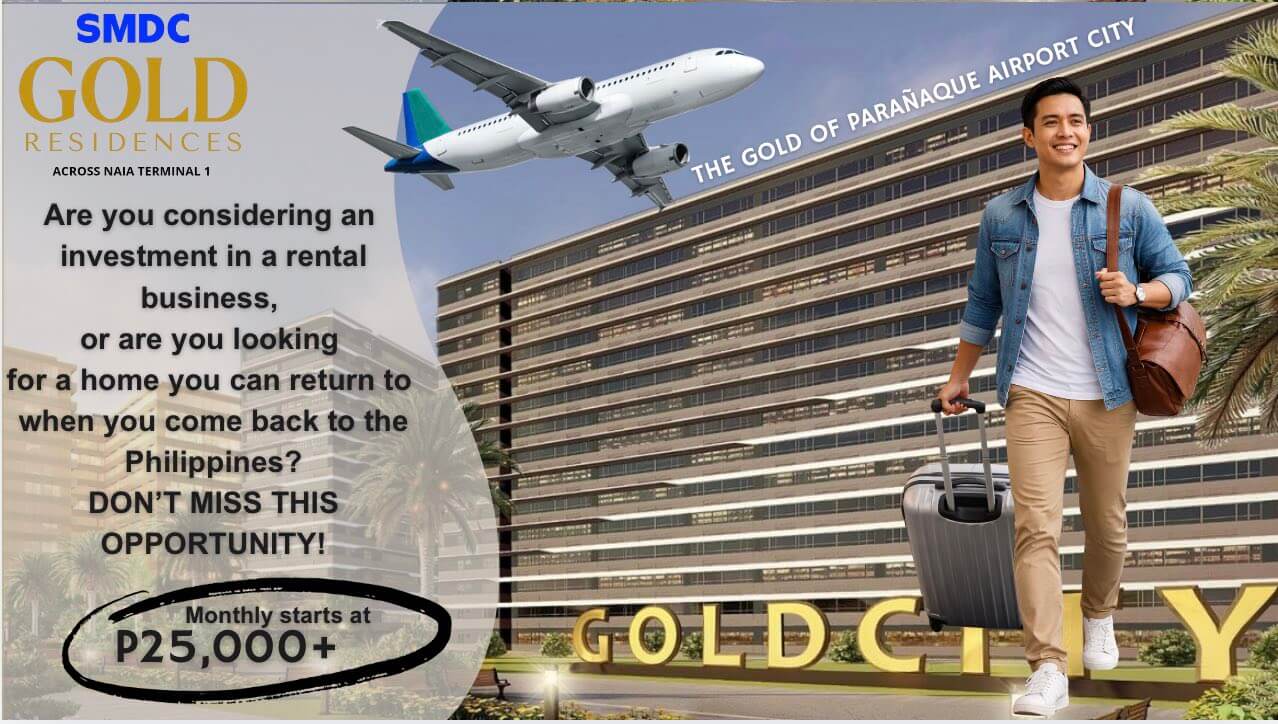

Some of these places are in tall office towers. Others are in busy shopping streets. Some can even be part of a mixed community with homes and shops together. For example, a mixed project can include a SMDC condo with nearby stores and offices that serve the people living there.

Types of Commercial Properties Available

Retail Buildings

Retail buildings are places where people shop. These can be small stores or big centers. They are built in busy areas so many people can visit. Shops inside can sell clothes, food, or daily items. Owners earn money when stores rent space.

Office Buildings

Office buildings are spaces where people work at desks. These can be small or tall. Many companies need clean and safe offices. Also, some buyers look for modern layouts and smart designs. One example is Gold Residential Offices which offers office space that is ready for business use.

Industrial Properties

Industrial properties are used for making, storing, or shipping goods. These can be big warehouses or small workshops. Many buyers like these places because they fit tools, machines, and trucks. They are often built near roads or ports for easy travel and deliveries.

Mixed Use

Mixed use properties have homes and shops in one place. This can make life easy since people can live, work, and shop close by. Also, it helps stores get more customers who live in the same area. One example is Zeal Residences which brings homes and shops together in one growing community.

Special Purpose

Special purpose buildings are made for one main use. These include hotels, resorts, clinics, or schools. They are different from simple stores or offices since they have special rooms or tools. One good example is Cool Suites at Wind Residences which blends living space with nearby leisure and tourism spots.

Why People Buy Commercial Properties

Many people choose to buy commercial buildings because they want to make money and grow their savings over time. These places work for shops, offices, and other business needs.

- Income potential: Buyers can rent out space to shops or offices. This gives steady monthly income that can help pay bills and loans. It can also give extra cash.

- Asset appreciation: These buildings can rise in value as the area grows. Buyers can earn more if they decide to sell in the future.

- Tax benefits: Owners may get helpful tax savings based on local rules. These savings can make owning cheaper each year.

- Business use: Some owners use the space for their own store or office. This lets them stop paying rent and build value instead.

Key Factors When Buying Commercial Properties

Location

Buyers always check the area first. Better spots bring more people and more business. It also makes the place easier to rent or sell later. This is why many look at busy roads, safe streets, and nearby services. Many shoppers browse commercial properties for sale in areas with strong foot traffic.

Zoning Rules

Cities have rules called zoning rules. These rules tell you what you can build and what type of work is allowed. You must check these rules so you do not break the law. Also, zoning rules can change, so it is smart to ask local offices for updates.

Building Condition

The shape of the building matters a lot. Older places may need repairs. Newer places may cost more. You should look at walls, roofs, floors, and lights. A clean and safe place can attract good tenants and help your plan run smoothly.

Lease Potential

Many buyers want to rent out space to make money. They check if the area needs shops or offices. They also check how long tenants will stay. This is called lease potential. Buyers look at these points when reviewing commercial rental properties for sale since steady rent helps cover costs.

Financing

Financing means getting the money to buy the place. Some pay in full. Others get loans from banks. A good credit score can help. Also, banks often check income and building value before they lend money. Good planning makes this part easier for new buyers.

How to Evaluate Commercial Properties

People use simple steps to check the value of buildings before they buy. This helps them make smart choices and avoid bad deals. Many investors search for commercial real estate properties for sale when planning long term growth. Others explore commercial properties for sale when they want steady rental income.

- Income approach: Buyers look at how much rent the place can earn. They check monthly rent and how often it is paid. Higher rent can mean higher value.

- Market comps: People compare the building to other buildings in the same area. They look at size, age, and price. If many places sell for high prices, this place may be worth more too.

- Replacement cost: Buyers ask how much it would cost to build the same place today. They check prices for labor and materials. If the cost is high, the building may be worth more.

- Cash flow analysis: People check how much money comes in and how much goes out. They add rent and take away bills and repairs. If money left over is strong, the building may be a good deal.

Understanding Leasing and Rental Income

People earn money from renting out business space. This rent can pay for loans, repairs, and extra costs. It can also give steady income each month which helps buyers plan ahead.

Cap Rates

Cap rates help people measure how much money a building can make. They compare the price of the building to the income it brings in each year. A lower cap rate can mean lower risk, while a higher cap rate can mean higher risk. Many buyers check cap rates when they review commercial investment properties for sale because it helps them see possible returns.

Long Term Leases

Long term leases are deals where tenants stay for many years. This gives owners steady rent and less empty time. It also helps owners plan their money better since they know rent will keep coming in. Long term leases can make a building more valuable since rent looks stable.

Tenant Quality

Tenant quality means how good or reliable the business tenant is. Good tenants pay rent on time and take care of the space. They also help the owner avoid long empty periods. Buyers check tenant quality when they look at commercial rental properties for sale because reliable tenants can make income safer and stronger.

Why Choose Us for Commercial Property Opportunities

Many buyers look at modern commercial projects because they want safe spaces, strong value, and useful features. They also explore commercial properties for sale when they want long term gains.

Quality Developments

Quality matters a lot. Good projects use strong materials and safe designs. They also have clean halls, working lights, and open areas. These things help tenants feel safe and welcome.

Good Locations

Many projects rise in places near roads, malls, and homes. This helps shops get more customers and offices get easy access. It also helps owners rent out units faster.

Growing Commercial Demand

More families and workers mean more need for shops and services. This makes business space useful and in demand. Buyers check this trend before they make a condo reservation and plan their next move.

Find the Right Commercial Property Today

Now is a great time to explore commercial properties for sale that match your goals. You can choose places that fit your budget and offer strong long term value. For more help, you can reach out through contact us and get clear guidance.

FAQs

What are commercial properties used for?

Commercial properties are used for business activities like selling goods, offering services, or running offices. They are not used as homes.

Who can buy a commercial property?

Anyone can buy a commercial property, including business owners, families, and investors. They just need proper documents and funds.

How do people earn money from commercial properties?

People earn money by renting out space to businesses. The rent can help pay costs and provide extra income.

Do commercial properties have higher risks than homes?

They can have different risks because business needs may change over time. Good research can help lower those risks.

What should I check before buying a commercial property?

You should check the location, building condition, zoning rules, and rental demand. These can affect value and income.