Many buyers ask is condominium a good investment? when looking for simple ways to build wealth through real estate. A condo can offer rental income, future appreciation, and access to prime city locations at a lower entry cost. It is also easy to maintain since building management handles repairs and shared spaces. With the right location and market research, a condo can fit long term investment goals.

What Does a Condominium Investment Mean

Understanding What a Condo Is

A condo is a small home inside a bigger building where many people live. You own your unit, and you share halls, elevators, and fun spaces like pools. People often look at an SMDC condo because the units are simple to manage and placed in busy city spots. It feels like living in your own space while still being part of a safe community.

How a Condo Works as an Investment

A condo can grow in value over time. You can also rent it out and earn money each month. Many people ask is condominium a good investment?, and it can be when the place has strong demand. The building takes care of repairs, so you do not need to fix things alone, which keeps everything easy for beginners.

How a Condo Differs From a Single Family Home

A single family home sits on its own land. A condo sits inside a shared building with many units. However, this setup makes daily living easier because you handle less work. Investors often say why condominium is a good investment when they want a simple entry into real estate. Homes need more upkeep, while condos stay easy to maintain.

Benefits and Reasons Why Condominium Is a Good Investment

Strong Rental Demand in Urban Areas

Condos in busy cities attract workers and students who need homes near offices and schools. Many ask is condominium a good investment? because city rentals give steady income when units stay occupied.

Lower Entry Price Compared to Houses

Houses cost more because of land and size. Condos are smaller, so the price is easier for first time buyers. Investors also join pre-selling to get lower rates and simple payment plans.

High Appreciation Potential in Key Cities

Condos near malls, transit lines, and offices can rise in value. As the area grows, demand increases, so owners can build wealth over time if they pick smart locations.

Access to Amenities and Prime Locations

Condos often include pools, gyms, and security, which attract tenants. Units near business districts and schools also rent faster because people like saving time when traveling each day.

Easier Management and Maintenance

Condos are simpler to handle than houses. The building takes care of repairs in shared areas, so owners deal with fewer chores. This makes renting easier for beginners.

Passive Income Opportunities

Owners can rent units long term or short term and collect steady payments. This setup helps investors earn passive income without daily work.

Key Risks to Consider Before Buying a Condominium

HOA Fees and Cost of Maintenance

Each condo building has a group that handles cleaning, repairs, and shared spaces. This group charges monthly HOA fees to keep things running. The fees can grow over time, so owners need to plan their budget well. HOA payments can also change if big repairs are needed in the building, which can surprise new buyers.

Rules on Rentals and Use of Units

Condo buildings often have rules about how you can use your unit. Some places limit short term rentals. Others set quiet hours or rules for pets. These rules help everyone stay safe and happy, but they can also limit how you earn from the unit. Buyers need to read these rules before buying to avoid problems later.

Market Oversupply and Vacancy Risks

Some cities build many condos at once. This can create too many units and not enough renters. As a result, owners may struggle to find tenants or may need to lower rent prices to compete. People also ask is condominium a good investment in the Philippines when they see many new towers. Buyers need to study the area so they do not face long empty months.

Slower Appreciation vs Single Family Homes

Condos sometimes grow in value slower compared to houses on land. Houses have land value, while condos do not. This means price growth can depend more on location and building condition. Investors who want quick gains may not like this pace. Buyers who want a simple home may not mind slower growth.

Factors That Decide if a Condominium Is a Good Investment

Location and Rental Demand

People want to live near schools, malls, and offices. A condo in a busy city gets more renters and stays filled longer. Many buyers ask is condominium a good investment? when they see strong rental demand in key city spots. Good public transport also helps tenants move fast without cars.

Price vs Future Value

Buyers need to compare the price today with how much the unit may grow in value. A cheap unit in a weak area may not grow much. However, a unit in a strong business district may rise over time. It helps to check malls, train lines, and future city plans before buying.

Size and Layout

Small units can rent fast because young workers like cozy spaces. Larger units may fit families but rent slower. The layout also matters since square rooms are easier to design and furnish. A clean and useful layout makes renters stay longer.

Building Age and Management

A new building looks fresh and attracts more buyers. Older buildings may need repairs. Owners also check if the building has good staff and clean areas. Some buyers pick ready for occupancy units to start using them faster.

HOA Rules and Restrictions

Each building has rules for pets, rentals, and shared spaces. These rules protect the place but can limit how owners use their units. Buyers should read rules before buying to avoid problems later.

Who Should Consider a Condominium Investment

Many people ask if a condominium is a good investment, and the answer depends on their needs and goals. Different groups can benefit from owning a condo because it is simple to manage, easy to maintain, and placed in good locations.

- First time investors: They enjoy condos because the cost is lower and the work is simple. It helps them learn how real estate works.

- Young professionals: They like living near jobs, malls, and transit. A condo keeps their travel short and their daily life easy.

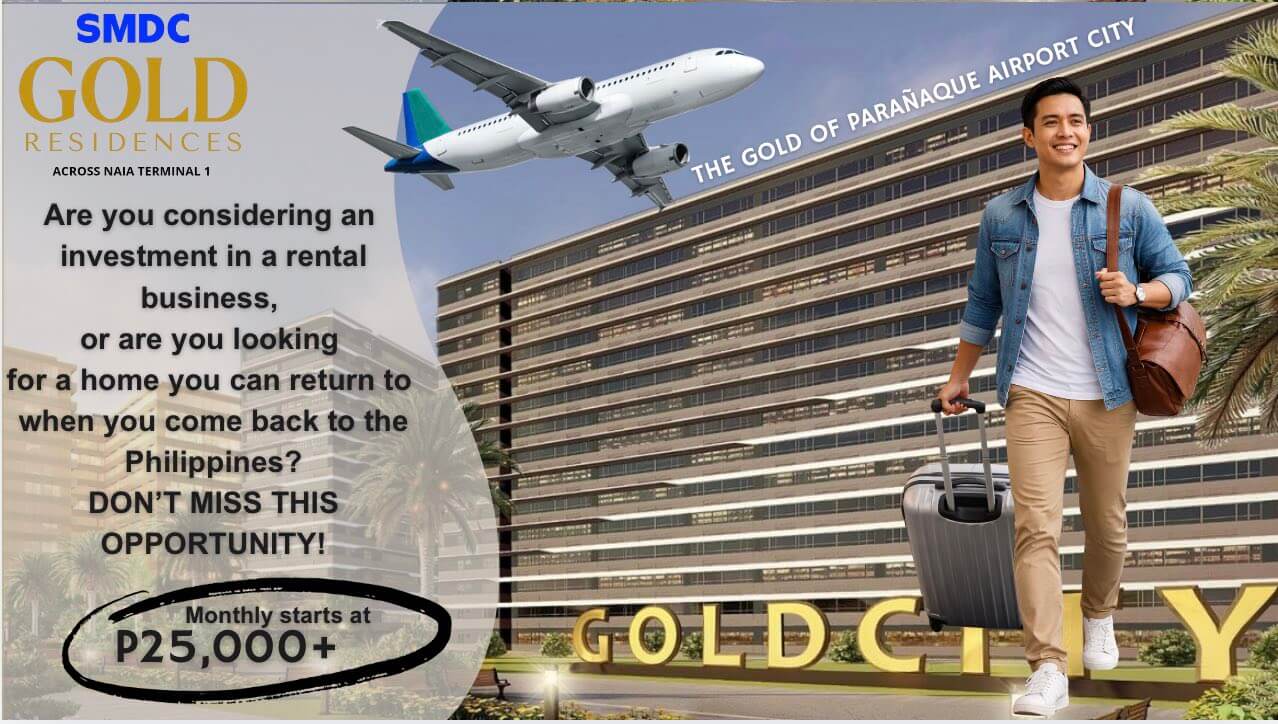

- OFWs: They invest in condos to build long term income while working abroad. It also gives them a place to use when they come home.

- Retirees: They choose condos because they want a home that needs little upkeep. The building staff handles repairs, which keeps life stress free.

- Parents buying for kids studying in cities: They want safe and clean spaces for their children. A condo near schools saves travel time and keeps their kids close to key places.

Is Condominium a Good Investment for Rentals

Short Term Rentals

Short term rentals serve tourists and visitors who stay for a few days or weeks. These guests look for clean rooms, Wi-Fi, and quick access to malls and landmarks. Owners can charge higher nightly rates, but bookings may change often, so they need time to manage check-ins and cleaning.

Long Term Rentals

Long term rentals serve students, workers, and small families who stay for months or years. These rentals give stable income and fewer turnovers. Owners do not need to clean after each stay, and they enjoy fewer tasks. This setup is popular in big cities where tenants want simple homes close to schools and offices.

Tourism Areas vs Business Districts

Tourism areas attract short term renters who want travel and leisure. Business districts attract long term renters who want to live near work. Each spot has its own rental strength, so buyers check the area first. People also ask is condominium a good investment in the Philippines since tourism and business zones are growing fast in large cities.

Yield and Occupancy Rates

Yield shows how much money the unit makes each year. Occupancy shows how often the unit has tenants. High yield and high occupancy mean the condo earns well. Investors check nearby buildings, rental listings, and vacancy reports to see if units stay filled during all seasons.

Simple Financial Examples

Numbers make rental income easier to understand:

- A unit rented for 20,000 pesos each month earns 240,000 pesos each year.

- If fees and taxes cost 60,000 pesos each year, the owner keeps 180,000 pesos.

- If the purchase price was 3,000,000 pesos, the yearly yield is 6 percent.

These simple calculations show why condominium is a good investment when the rental income stays strong for many years. Some buyers also complete a condo reservation early to secure units in high demand areas and maximize future rental income.

Secure Your Condo Investment Opportunity Today

A condo is a smart choice for long term returns, so is condominium a good investment for your goals. Explore top locations, flexible payment terms, and ready units that fit your needs. To learn more about listings and availability, please contact us for assistance.

FAQs

1. Are condominiums good for first time investors?

Yes, condos are good for beginners because they are cheaper than houses and easier to manage. The building staff handles repairs, so owners do not deal with many tasks.

2. Do condominiums increase in value over time?

Condos can increase in value when they are in good locations near schools, malls, and business areas. Growth depends on demand, building quality, and city development.

3. Can I rent out my condominium unit?

Many condos allow rentals, but some buildings have rules. It is important to check rental rules before buying so you understand what is allowed.

4. Are there extra fees when owning a condominium?

Yes, owners pay monthly HOA fees. These fees cover cleaning, security, and shared spaces like pools and elevators. Fees can change over time.

5. Is condo living safe for families and students?

Yes, many buildings have security guards, cameras, and controlled entry. Families and students also like that condos are close to schools, malls, and transport.